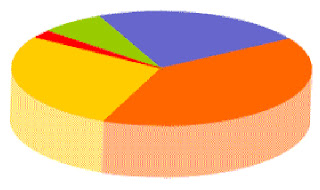

Broadly speaking, there are four main asset classes into which one can invest: Cash, Fixed Interest Securities, Property and Equities, although there are many additional sub-divisions within each class.

Each asset class has different characteristics, an expected risk and return profile and performs an alternative but essential function in a well constructed and diversified overall investment strategy.

As such, the importance of appropriate asset allocation and diversification across and within asset classes cannot be underestimated, as it is crucial to the reduction of overall investment risk and volatility, through the combination of asset classes and their sub-divisions which are said to have a 'negative correlation' to one another - that is, they don't follow each other's market movements closely and in fact, may tend to move in opposite directions.

Put simply, this means that if one asset class or sub-division thereof is performing poorly at a given time, another should be performing better and thus your overall return should be smoother than if your portfolio contained only the one asset class. To use a popular expression, it is the investment equivalent of 'not putting all of your eggs in one basket'.

To give a practical example of the value of diversification, in this case within an individual asset class, in the very difficult market conditions we all experienced between September 2008 and March 2009, an equity portfolio which was comprised of the constituents of, say, the FTSE 100 index, would have suffered a fall in value of around 40% at its lowest point. In contrast, an equity portfolio which was comprised of only banking stocks would have suffered a fall in value of around 90%, so it is clear that diversification is critical.

Perhaps the clearest benefit of combining asset classes correctly, however, is that academic research tells us that this is the single most important factor in determining long-term investment performance, with over 90% of returns being generated through suitable asset allocation and less than 5% coming from fund and stock selection - despite active investment managers' and stockbrokers' misplaced belief to the contrary.

For these reasons, a key aspect of the Reeves investment process involves working with you to establish the ideal asset balance for your portfolio, in order to help you to obtain your desired investment returns in accordance with your personal circumstances, objectives and risk profile.

No comments:

Post a Comment