When many are failing to get into work, the troops have all made it in today. Work continues and after getting back into the markets we are glad they have improved again. Here are todays figures.

FTSE 100 5641.41 + 113.14

Dax 6844.06 + 155.57

Cac 40 3660.77 + 50.33

Dow Jones 11192.62 + 186.6

Nasdaq 2542.67 + 44.44

BBC Global 30 5532.77 + 86.03

Well done! You found our secret corner. Your prize is a free consultation worth £250 with one of our financial advisers, ring 08712711280 to claim your prize with promotional code: Chris Lockerbie.

Wednesday, 1 December 2010

Thursday, 28 October 2010

This Week @ Reeves Independent

Today has been a pretty hectic one for us in the office.

Steve our new para-planner is now fully settled in and by all means thoroughly enjoying being part of the team. We currently have lots of work going on (good thing) so he has lots to get on with.

Liam has been interviewing half of Newcastle for the position on promotional staff that we are currently recruiting and after a few dozen phone interviews has selected the best candidates to come into the office tomorrow afternoon for some training.

Tomorrow is week 3 of the Reeves Independent Training Academy. Nigel has gave a really good introduction to the company and a start on the "approach" the next couple of weeks will really make or break the candidates as they will be doing practical training such as face to face dummy runs which will show us who we want working on our stands. Last week, new recruit James, was the first to feed through from the training academy and although I wasn't there the guys on the stand said he did brilliantly, so well done to him.

Patrick Leonard attended an Invesco seminar yesterday at the wonderful Marriot Hotel in Gateshead. Our Marketing man picked up lots of advice and opinions on the markets which will hopefully give him the grounds to write some very good articles on this very blog. I know he has taken some fantastic information from them about their review of the markets so look out for monthly reviews.

Our football team, Newcastle Chemfica are doing extremely well in the Northern Alliance division 2 and are sitting in the top 3, this weekend they entertain Red House Farm at Cochrane park. Red House are a new, youthful team that will provide the lads with a difficult test. We now do programmes on a matchday, so if you are interested in sponsoring that, let us know.

Reeves.

Steve our new para-planner is now fully settled in and by all means thoroughly enjoying being part of the team. We currently have lots of work going on (good thing) so he has lots to get on with.

Liam has been interviewing half of Newcastle for the position on promotional staff that we are currently recruiting and after a few dozen phone interviews has selected the best candidates to come into the office tomorrow afternoon for some training.

Tomorrow is week 3 of the Reeves Independent Training Academy. Nigel has gave a really good introduction to the company and a start on the "approach" the next couple of weeks will really make or break the candidates as they will be doing practical training such as face to face dummy runs which will show us who we want working on our stands. Last week, new recruit James, was the first to feed through from the training academy and although I wasn't there the guys on the stand said he did brilliantly, so well done to him.

Patrick Leonard attended an Invesco seminar yesterday at the wonderful Marriot Hotel in Gateshead. Our Marketing man picked up lots of advice and opinions on the markets which will hopefully give him the grounds to write some very good articles on this very blog. I know he has taken some fantastic information from them about their review of the markets so look out for monthly reviews.

Our football team, Newcastle Chemfica are doing extremely well in the Northern Alliance division 2 and are sitting in the top 3, this weekend they entertain Red House Farm at Cochrane park. Red House are a new, youthful team that will provide the lads with a difficult test. We now do programmes on a matchday, so if you are interested in sponsoring that, let us know.

Reeves.

UK Overview September

October 2010 (covering the month of September 2010)

UK stocks were strong in September with the FTSE 100 and FTSE All-Share indices regaining positive territory for the year. The month’s strength was based around a general increase in global risk aversion and largely solid corporate newsflow, albeit that economic data domestically remained unconvincing.

Economic data released during the month added further evidence to the difficult outlook ahead. Service sector activity, a significant driver of growth, dropped to 51.3 in August, from 53.1 in July, according to the CIPS/Markit survey. The housing market experienced further signs of a downturn, as data from Nationwide, Rightmove and the Royal Institute of Chartered Surveyors showed prices falling due to an increase in supply at a time when demand is challenged by mortgage availability and concerns about the outlook for employment. This was reinforced by data showing that while the availability of mortgage credit had actually increased slightly over the last three months, the number of mortgage approvals for new house purchases fell to its lowest level for six months, based on data from the Bank of England. Retail sales data was mixed, with the ONS reporting a fall in sales during August, while the CBI’s September survey suggested that high street sales are expanding strongly.

Results from retailers, including DSG international and Debenhams, were positive, but both warned of uncertainty ahead for the UK consumer. DSG reported an increase in sales, boosted by the World Cup and iPad sales, while Debenhams forecast full-year pre-tax profits of £150m. Banking stocks were in the news as both Barclays and HSBC announced board changes. Bob Diamond, formerly head of the investment banking arm Barclays Capital, was appointed as the bank’s new chief executive. HSBC’s changes saw chairman Steven Green confirmed as the government’s new trade minister, to be replaced by the group’s chief financial officer Douglas Flint. Chief executive Michael Geoghegan was also replaced by a former investment banker, with Stuart Gulliver taking over as CEO. Lloyds Banking Group also revealed that chief executive Eric Daniels will leave over the next 12 months. WM Morrison issued first half results that were ahead of forecasts and Imperial Tobacco’s trading update was well received by the market. Merger and acquisition news also supported stocks during the month as BAE Systems announced plans to sell parts of its North American business, with proceeds expected to be in the region of $2bn. KNOC’s drawn-out bid for Dana Petroleum appeared to be heading towards a conclusion as the group gained control of more than 64% of the group’s stock.

September Markets Review

October 2010 (covering the month of September 2010)

September turned out to be a positive month for equities with US stocks leading the rally. Willingness from the US Federal Reserve to provide further monetary stimulus via quantitative easing and its commitment to reflate the US economy boosted investor confidence and risk appetite. European equities also registered healthy gains despite further reminders that the Eurozone’s fiscal crisis is far from over. Positive corporate newsflow underpinned UK stocks although economic data released here during the month added further evidence to the difficult outlook ahead. Broad weakness in the US dollar pushed the euro higher and prompted the authorities in Japan to intervene in the currency markets to weaken the yen. Commodities had a strong month with oil and gold prices rising sharply. In fixed income markets, core government bonds delivered negative returns and 10-year yield spreads for Greek, Irish and Portuguese bonds over German Bunds remain elevated.

US

- Better-than-expected macro data dampens down fears of a double-dip recession

- S&P 500 has its best September since 1939, rising by 8.8% in US dollar terms

- Technology and industrials the best performing sectors

Europe

- Equity markets rally as corporate newsflow remains upbeat

- Spain downgraded by Moody’s while Ireland bails out the banking sector

- Euro rises to six-month high versus the US dollar

UK

- UK stocks regain positive territory for the year-to-date

- Mixed economic data suggests a challenging outlook

- Significant board room changes within the banking sector

Asia Pacific

- Japanese authorities intervene in currency markets to weaken the yen

- Japan’s second quarter GDP revised up to an annualised rate of 1.5% from initial estimate of 0.4%

- Improvement in Chinese economic data renews concerns of further tightening

Emerging Markets

- Double-digit returns for emerging market equities

- Rally driven by better economic data from US and China

- Brazil’s Petrobras raises US$70 billion in the world’s largest public share offering

Fixed Interest

- Negative returns from core government bonds and better quality investment-grade bonds, but stronger performance from high yield

- Clarity around bank capital requirements sees subordinated bank debt improve

- UK inflation remains stubbornly high

Wednesday, 20 October 2010

Key Points From Today's Spending Cuts

Chancellor George Osborne has unveiled the biggest UK spending cuts since World War II, with welfare, councils and police budgets all hit.

- £81bn cut from public spending over four years

- £81bn cut from public spending over four years

- 19% average departmental cuts - less than the 25% expected

- £7bn extra welfare cuts, including changes to incapacity, housing benefit and tax credits

- £3.5bn increase

- Rise in state pension age brought forward

- 7% cut for local councils from April next year

- Permanent bank levy

- Rail fares to rise 3% above inflation from 2012

Today's Markets

Poor day for the markets. (20/10/10)

FTSE 100 5686.48 - -17.41

Dax 6465.24 - -25.45

Cac 40 3787.59 - -19.58

Dow Jones 10978.62 - -165.07

Nasdaq 2436.95 - -43.71

BBC Global 30 5407.35 - -3.73

FTSE 100 5686.48 - -17.41

Dax 6465.24 - -25.45

Cac 40 3787.59 - -19.58

Dow Jones 10978.62 - -165.07

Nasdaq 2436.95 - -43.71

BBC Global 30 5407.35 - -3.73

Tuesday, 19 October 2010

Tuesday's Markets

FTSE 100 5733.67 - -8.85

Dax 6527.21 + 10.58

Cac 40 3832.71 - -1.79

Dow Jones 11143.69 + 80.91

Nasdaq 2480.66 + 11.89

BBC Global 30 5433.97 + 8.88

Dax 6527.21 + 10.58

Cac 40 3832.71 - -1.79

Dow Jones 11143.69 + 80.91

Nasdaq 2480.66 + 11.89

BBC Global 30 5433.97 + 8.88

Thursday, 14 October 2010

Today's Markets

Wednesday, 13 October 2010

Day 1

Today is an exciting day for Reeves Independent as Nigel Reeves launches the Reeves Independent Training Academy. Students from the cities top universities have been invited to partake in a training scheme that will give them experienced and skilled expertise in sales/marketing and business.

The students are currently in our board meeting listening to Nigel talk about who we are, what we do and what we want to achieve. Nigel is then going to talk the students through basic sales techniques concentrating initially on "how to approach a potential lead" and then concluding with "identifying a lead" and "qualifying a lead".

All of the students will be given a chance to test their skills on our promotion stands in the upcoming weeks and today have been informed that they can earn up to £240 for six hours work.

We have students from Ireland, Spain and Latvia attending today and we wish them all the very best of luck and success in their future in sales.

The students are currently in our board meeting listening to Nigel talk about who we are, what we do and what we want to achieve. Nigel is then going to talk the students through basic sales techniques concentrating initially on "how to approach a potential lead" and then concluding with "identifying a lead" and "qualifying a lead".

All of the students will be given a chance to test their skills on our promotion stands in the upcoming weeks and today have been informed that they can earn up to £240 for six hours work.

We have students from Ireland, Spain and Latvia attending today and we wish them all the very best of luck and success in their future in sales.

Todays Markets

FTSE 100 5731.49 + 69.9

Dax 6396.28 + 91.71

Cac 40 3803.08 + 54.22

Dow Jones 11020.4 + 10.06

Nasdaq 2417.92 + 15.59

BBC Global 30 5411.99 + 17.28

Dax 6396.28 + 91.71

Cac 40 3803.08 + 54.22

Dow Jones 11020.4 + 10.06

Nasdaq 2417.92 + 15.59

BBC Global 30 5411.99 + 17.28

Tuesday, 5 October 2010

The Fundamental Principles of Investing

Whilst some of what follows may seem obvious to many, the essential principles of investing are often forgotten or poorly understood, but it is vital that they are considered and comprehended, because they are fundamental to the questions all investors should not only ask, but more importantly, have answered before making an investment of any kind.

Particularly important questions and issues are:

'Should I be investing at all?'

'What are my investment objectives?'

'Is it financially worthwhile for me to invest?'

Our view is that it is impossible to answer the first two of these questions if you do not have a roadmap charting your financial journey through life to your desired destination - or in other words, a proper financial plan.

This is because only by going through the rigours of the full financial planning process will you or your advisers be in a position to make considered, informed decisions about such important matters as whether an investment portfolio is appropriate for you and what level of return you require in order to help you to achieve your financial and life goals.

This is because only by going through the rigours of the full financial planning process will you or your advisers be in a position to make considered, informed decisions about such important matters as whether an investment portfolio is appropriate for you and what level of return you require in order to help you to achieve your financial and life goals. In considering the answer to the third question, however, it would be worthwhile revisiting a few of the basic features of the capitalist society in which we live:

When you deposit your money with a Bank, Building Society or Government, you are essentially providing them with capital that they can use to finance or expand their wider business or Governmental activities. In exchange for this deposit of capital, you will be offered a relatively low return in the form of interest payments, but with a comforting guarantee that the nominal value of your money will not fall.

However, even though the nominal value of your money will be protected if you choose to only hold cash deposits, you must keep in mind that the real value of your money may well be eroded over time by the pernicious effects of inflation, if you choose to pursue a cash-only investment strategy. Indeed, as we always remind our clients, it is all too easy to underestimate the negative power of inflation or assume that because you can't 'see or feel' it happening, it doesn't exist. Inflation has real consequences and must be taken seriously.

When you invest your money in the shares of companies (equities), you are also providing those companies with capital that they can use to finance or expand their business activities. In exchange for this input of capital, they will try to provide you with a relatively high return in the form of a growth in the value of your capital and usually dividend income as well.

However, the companies in question cannot guarantee that you will receive any dividend income payments, nor can they guarantee that the nominal value of your money will not fall and this uncertainty means that there is an inherent and sometimes discomforting risk involved in offering your capital to companies.

Despite this, there is an observed and accepted phenomenon, supported by a mass of research and data, that over the longer term the returns from equities are considerably greater than those from all other asset classes and importantly, the returns are also significantly greater than the long-term rate of inflation.

This increased long-term return from equities is known as the 'equity premium' - i.e. the greater reward delivered to an investor in exchange for their willingness to take a greater level of risk with their capital, by providing it to companies through the purchase of their shares.

To summarise, with investing as in all other aspects of life, it is essential that investors accept there is no such thing as a 'free lunch', whereby the high returns and inflation-beating capabilities of equities can be accessed by taking the low risk associated with cash deposits.

At Reeves Independent, our one aim is to help achieve your goal. Whether you want to go down the slow and steady route or if you would prefer to enter into some high risk investments, the decision is on you. We don’t want to make a quick buck from you and we would like to enter a long term business relationship that will see you benefit from our 20 years experience and trained expertise.

Thursday, 30 September 2010

Asset Allocation & Diversification

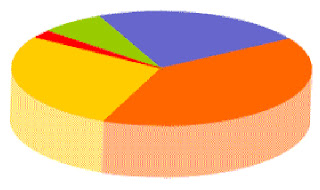

Broadly speaking, there are four main asset classes into which one can invest: Cash, Fixed Interest Securities, Property and Equities, although there are many additional sub-divisions within each class.

Each asset class has different characteristics, an expected risk and return profile and performs an alternative but essential function in a well constructed and diversified overall investment strategy.

As such, the importance of appropriate asset allocation and diversification across and within asset classes cannot be underestimated, as it is crucial to the reduction of overall investment risk and volatility, through the combination of asset classes and their sub-divisions which are said to have a 'negative correlation' to one another - that is, they don't follow each other's market movements closely and in fact, may tend to move in opposite directions.

Put simply, this means that if one asset class or sub-division thereof is performing poorly at a given time, another should be performing better and thus your overall return should be smoother than if your portfolio contained only the one asset class. To use a popular expression, it is the investment equivalent of 'not putting all of your eggs in one basket'.

To give a practical example of the value of diversification, in this case within an individual asset class, in the very difficult market conditions we all experienced between September 2008 and March 2009, an equity portfolio which was comprised of the constituents of, say, the FTSE 100 index, would have suffered a fall in value of around 40% at its lowest point. In contrast, an equity portfolio which was comprised of only banking stocks would have suffered a fall in value of around 90%, so it is clear that diversification is critical.

Perhaps the clearest benefit of combining asset classes correctly, however, is that academic research tells us that this is the single most important factor in determining long-term investment performance, with over 90% of returns being generated through suitable asset allocation and less than 5% coming from fund and stock selection - despite active investment managers' and stockbrokers' misplaced belief to the contrary.

For these reasons, a key aspect of the Reeves investment process involves working with you to establish the ideal asset balance for your portfolio, in order to help you to obtain your desired investment returns in accordance with your personal circumstances, objectives and risk profile.

Client 'Wrap Accounts'

Before taking an in-depth look at the principles of our investment philosophy, we thought it would be helpful to explain one of the important features of Reeves' investment proposition; namely the use of client 'wrap accounts', which are designed to complement and assist the ongoing financial planning and wealth management process.

In brief, instead of the traditional and often haphazard composition of a client's assets, which might be dispersed amongst a variety of financial institutions, a wrap account is an administration service offered by an independent, specialist provider, which enables you to hold all of your assets - be they your general investment portfolio, pensions, investment bonds, ISAs, etc - in one place.

You no longer need to deal with several different companies to achieve specific objectives in your overall financial planning strategy, nor do you have to receive masses of paperwork from each of them, nor find yourself wondering how your portfolio has been performing.

In our view, wrap accounts are very cost-effective and essential to the improvement of your financial organisation, as well as being central to the provision of a professional wealth management service, both now and into the future.

A detailed appraisal of the features and benefits of your private wrap account is not appropriate here, but in summary, it provides:

- Simplicity

- Transparency

- Consolidation of your financial affairs and statements

- The functionality to deliver the smooth, efficient management of your assets

- Quick and easy implementation or change of financial planning strategies

- Access to low cost, institutional investment funds

- Unrestricted tax planning opportunities / investment choices

- The ability to receive your income payments from just one source

- A significant reduction in paperwork and administration

- Immediate, secure access to your portfolio via Reeves' website

Quote Of The Day 30/8/10

"The idea that any single individual can beat the market is extraordinarily unlikely. Yet the market is full of people who think they can do it and full of other people who believe them." Daniel H. Kahneman, 2002 Nobel Laureate in Economics

Thursday, 23 September 2010

Tuesday, 21 September 2010

Thursday, 16 September 2010

Preparing for Unemployment

In our blog we always tell you WHY you should start investing money and why you should invest in a pension.

Every reason we have given you to invest so far has been about positives. "A great future for you and your loved ones" "Maintaining a luxury life without income" "Chase your ambitions". However it's not that easy for everyone. In the past 12 months we have all saw unemployment rates climbing at a staggering rate and with the new coalitions cuts it looks possible that there could be more people losing their jobs,

Every reason we have given you to invest so far has been about positives. "A great future for you and your loved ones" "Maintaining a luxury life without income" "Chase your ambitions". However it's not that easy for everyone. In the past 12 months we have all saw unemployment rates climbing at a staggering rate and with the new coalitions cuts it looks possible that there could be more people losing their jobs,

If you have experience in your profession and your work history is good then you will more than likely find a job. For most it's when not if the next job is coming around the corner and if you are financially prepared then losing your job will just be a minor setback. If you aren't prepared then it could result in an absolute financial disaster.

Below are some figures on unemploment in the UK

Yorks/Humber: 242,000

Wales: 121,000

Scotland: 239,000

North West: 297,000

South East: 273,000

Northern Ireland: 57,000

North East: 118,000

East: 204,000

East Midlands: 169,000

London: 380,000

West Midlands: 226,000

South West: 162,000

Hopefully you are reading this as a working person and not somebody who is unemployment and unprepared. For more information about Unemployment and Job loss protection plans ring Reeves Independent on 0871 271 1280 or email pat@reevesifa.com for more info.

Monday, 6 September 2010

Fund Focus August 2010

Fund Focus – August 2010

ETF Securities Physical Gold (Exchange Traded Commodity)

Fund aims

ETFS Physical Gold (PHAU) is designed to offer investors a simple, cost-efficient and secure way to access the precious metals market. PHAU is intended to provide investors with a return equivalent to movements in the gold spot price less fees.

Key Facts

Tracks the price of gold, not a portfolio of equities

Simple to trade on a major stock exchange

Settled and traded in ordinary broker accounts

Transparent tracking with clear pricing

Backed by physical, allocated metal

Provides additional portfolio diversification

Able to short, and margin eligible

0.39% total expense ratio

About exchange traded commodities

ETCs track commodities - not commodity companies - and enable investors to gain exposure to commodities without trading futures or taking physical delivery (i.e. receiving 10 tonnes of wheat on your doorstep!).

Benefits

Accurate ETCs accurately track the underlying commodity index or individual commodity

Liquid ETCs are open-ended securities, and therefore are not limited to on-exchange volumes

Accessible ETCs are traded and settled on regulated stock exchanges, the same as any equity, and can be purchased and held in ordinary brokerage or custodial accounts

Simple ETCs do not involve any of the difficulties with buying and then managing a futures position (eg. worrying about margin calls, contracts expiring and rolling positions) or in buying and storing physical commodities

Transparent ETC pricing is based on a transparent formula with the pricing updated daily on the ETF Securities website

Flexible: Investors can go long or short ETCs

About Gold

There are a number of reasons why one would hold gold in their overall portfolio:

As a hedge against inflation

As a safe haven in times of geopolitical and financial market instability

As a commodity, based on gold’s supply and demand fundamentals

As a store of value

As a portfolio diversifier

Gold is a monetary metal whose price is determined by inflation, by fluctuations in the dollar and U.S. Stocks, by currency related crisis, interest rate volatility and international tensions, and by increases or decreases in the prices of other commodities. The price of gold reacts to supply and demand changes and can be influenced by consumer spending and overall levels of affluence.

Gold is different from other precious metals such as platinum, palladium and silver because the demand for these precious metals arises principally from their industrial applications. Gold is produced primarily for accumulation; other commodities are produced primarily for consumption. Gold’s value does not arise from its use and worldwide acceptance as a store of value. Gold is money.

Comments

The ETF Securities Physical Gold ETC was included in the aggressive portfolio for the first time at the last review. This was partly motivated by our desire to diversify the types of asset held (i.e. equities, fixed interest, commodities etc) and partly due to our view that markets would remain volatile over the proceeding quarter. Over the 1 month period (to 27/08/2010) the security has returned 4.68%* and over the 3 month period (to 27/08/2010) has returned 1.99%.*

Any investor thinking about holding gold as an investment should seriously consider the five reasons for holding gold listed above. To what extent do you feel inflation will rise? Do you see any end to the current economic turbulence? Will commodity prices generally rise over the long term? These are all questions you should be asking yourself.

With a portfolio review imminent we will be revising our thoughts on gold as an investment in the very near future. To discuss any of the issues raised above please contact an adviser.

*information correct as at 27/08/2010. Source: Morning star

Reeves Independent, 47 St. Georges Terrace, Jesmond, Newcastle upon-Tyne

0871 271 1280

Authorised and Regulated by the Financial Services Authority

This document is intended to provide general information and does not represent a personal recommendation of any service or product. The value of investments can fall as well as rise and you may not get back the full amount invested. Past performance is not a guide to future returns. The sections within this document are opinion onlyand do not constitute advice. Other charges may be applicable and are subject to change without prior notice. Please refer to our brochure for information on our other products and services. We will always recommend that our clients seek advice before making a decision on whether to invest.

ETF Securities Physical Gold (Exchange Traded Commodity)

Fund aims

ETFS Physical Gold (PHAU) is designed to offer investors a simple, cost-efficient and secure way to access the precious metals market. PHAU is intended to provide investors with a return equivalent to movements in the gold spot price less fees.

Key Facts

Tracks the price of gold, not a portfolio of equities

Simple to trade on a major stock exchange

Settled and traded in ordinary broker accounts

Transparent tracking with clear pricing

Backed by physical, allocated metal

Provides additional portfolio diversification

Able to short, and margin eligible

0.39% total expense ratio

About exchange traded commodities

ETCs track commodities - not commodity companies - and enable investors to gain exposure to commodities without trading futures or taking physical delivery (i.e. receiving 10 tonnes of wheat on your doorstep!).

Benefits

Accurate ETCs accurately track the underlying commodity index or individual commodity

Liquid ETCs are open-ended securities, and therefore are not limited to on-exchange volumes

Accessible ETCs are traded and settled on regulated stock exchanges, the same as any equity, and can be purchased and held in ordinary brokerage or custodial accounts

Simple ETCs do not involve any of the difficulties with buying and then managing a futures position (eg. worrying about margin calls, contracts expiring and rolling positions) or in buying and storing physical commodities

Transparent ETC pricing is based on a transparent formula with the pricing updated daily on the ETF Securities website

Flexible: Investors can go long or short ETCs

About Gold

There are a number of reasons why one would hold gold in their overall portfolio:

As a hedge against inflation

As a safe haven in times of geopolitical and financial market instability

As a commodity, based on gold’s supply and demand fundamentals

As a store of value

As a portfolio diversifier

Gold is a monetary metal whose price is determined by inflation, by fluctuations in the dollar and U.S. Stocks, by currency related crisis, interest rate volatility and international tensions, and by increases or decreases in the prices of other commodities. The price of gold reacts to supply and demand changes and can be influenced by consumer spending and overall levels of affluence.

Gold is different from other precious metals such as platinum, palladium and silver because the demand for these precious metals arises principally from their industrial applications. Gold is produced primarily for accumulation; other commodities are produced primarily for consumption. Gold’s value does not arise from its use and worldwide acceptance as a store of value. Gold is money.

Comments

The ETF Securities Physical Gold ETC was included in the aggressive portfolio for the first time at the last review. This was partly motivated by our desire to diversify the types of asset held (i.e. equities, fixed interest, commodities etc) and partly due to our view that markets would remain volatile over the proceeding quarter. Over the 1 month period (to 27/08/2010) the security has returned 4.68%* and over the 3 month period (to 27/08/2010) has returned 1.99%.*

Any investor thinking about holding gold as an investment should seriously consider the five reasons for holding gold listed above. To what extent do you feel inflation will rise? Do you see any end to the current economic turbulence? Will commodity prices generally rise over the long term? These are all questions you should be asking yourself.

With a portfolio review imminent we will be revising our thoughts on gold as an investment in the very near future. To discuss any of the issues raised above please contact an adviser.

*information correct as at 27/08/2010. Source: Morning star

Reeves Independent, 47 St. Georges Terrace, Jesmond, Newcastle upon-Tyne

0871 271 1280

Authorised and Regulated by the Financial Services Authority

This document is intended to provide general information and does not represent a personal recommendation of any service or product. The value of investments can fall as well as rise and you may not get back the full amount invested. Past performance is not a guide to future returns. The sections within this document are opinion onlyand do not constitute advice. Other charges may be applicable and are subject to change without prior notice. Please refer to our brochure for information on our other products and services. We will always recommend that our clients seek advice before making a decision on whether to invest.

Exchange Traded Funds

Many people will have read something about ETFs however given that it is a simple concept, very few people really know what ETFs are. Below are some key points that you should be aware of when investing within an ETF.

What is an ETF - Summary of the concept

An ETF is a pooled investment fund similar to a unit trust or mutual fund, which can be bought and sold on a stock exchange, like ashare in a company.

Essentially an ETF is an index tracking fund. Its aim is to provide investors with the same return as the chosen index - (i.e. the FTSE 100 or the S&P 500). For example, if the FTSE 100 index goes up by 10% during a year, an ETF tracking this index should provide investors with exactly the same return, minus fees.

ETFs track most major indices for stocks, bonds, commodities and other asset types. Sector based ETFs are also available, offering access to specific industries.

The Benefits

ETF’s offer a range of benefits to investors and can enhance a portfolio in the following ways:

Transparency

Investment objective of the fund is simply to track an index

There is daily disclosure of the underlying securities of the fund

ETFs carry an explicit total expense ratio

Liquidity

ETFs are listed on exchanges and can be traded at any time the market is open

An ETF is as liquid as its underlying securities

Diversification

At fund level: holding the entire index in just one trade

At portfolio level: ETFs cover a full spectrum of asset classes.

Flexibility

Intraday trading: as easy to get in as to get out

Cost effectiveness

ETFs offer a cost effective route to diversified market exposure

The average total expense ration (the overall annual cost of the fund) for ETFs in Europe is 0.31% per annum versus 0.87% per annum for the average index tracking fund.*

What type of ETF’s are available?

There are a range of different companies offering ETFs throughout the UK and Europe. They can offer some of the following indices to track:

FTSE 100; FTSE 250; MSCI Europe; S&P 500; MSCI world; MSCI Japan; MSCI Emerging Markets; MSCI Latin America; MSCI Brazil; S&P

Global Timber and Forestry; S&P Global Clean Energy; £ Corporate Bonds; DJ STOXX 600 Basic Resources.

Some of the aforementioned indices will mean more than others but they show the diverse range of assets you can hold within ETFs.

TO SEE HOW ETFs CAN ENHANCE YOU PORTFOLIO PLEASE CONTACT ONE OF OUR ADVISERS ON 0871 271 1280.

*Source: iShares “ETF: A Guide For UK Financial Advisers”. From: Morningstar, ETF Research and Implementation Strategy Team, As at end March 2009.

What is an ETF - Summary of the concept

An ETF is a pooled investment fund similar to a unit trust or mutual fund, which can be bought and sold on a stock exchange, like ashare in a company.

Essentially an ETF is an index tracking fund. Its aim is to provide investors with the same return as the chosen index - (i.e. the FTSE 100 or the S&P 500). For example, if the FTSE 100 index goes up by 10% during a year, an ETF tracking this index should provide investors with exactly the same return, minus fees.

ETFs track most major indices for stocks, bonds, commodities and other asset types. Sector based ETFs are also available, offering access to specific industries.

The Benefits

ETF’s offer a range of benefits to investors and can enhance a portfolio in the following ways:

Transparency

Investment objective of the fund is simply to track an index

There is daily disclosure of the underlying securities of the fund

ETFs carry an explicit total expense ratio

Liquidity

ETFs are listed on exchanges and can be traded at any time the market is open

An ETF is as liquid as its underlying securities

Diversification

At fund level: holding the entire index in just one trade

At portfolio level: ETFs cover a full spectrum of asset classes.

Flexibility

Intraday trading: as easy to get in as to get out

Cost effectiveness

ETFs offer a cost effective route to diversified market exposure

The average total expense ration (the overall annual cost of the fund) for ETFs in Europe is 0.31% per annum versus 0.87% per annum for the average index tracking fund.*

What type of ETF’s are available?

There are a range of different companies offering ETFs throughout the UK and Europe. They can offer some of the following indices to track:

FTSE 100; FTSE 250; MSCI Europe; S&P 500; MSCI world; MSCI Japan; MSCI Emerging Markets; MSCI Latin America; MSCI Brazil; S&P

Global Timber and Forestry; S&P Global Clean Energy; £ Corporate Bonds; DJ STOXX 600 Basic Resources.

Some of the aforementioned indices will mean more than others but they show the diverse range of assets you can hold within ETFs.

TO SEE HOW ETFs CAN ENHANCE YOU PORTFOLIO PLEASE CONTACT ONE OF OUR ADVISERS ON 0871 271 1280.

*Source: iShares “ETF: A Guide For UK Financial Advisers”. From: Morningstar, ETF Research and Implementation Strategy Team, As at end March 2009.

Friday, 27 August 2010

Current Economic Thoughts (Aug2010)

Investment Update

We are adding a new monthly installment to our Blog called Current Economic Thoughts. We will use it to show you the analysis of the markets and economy over the last month and finalise it with thoughts on the future. This is the August 2010 version.

As you know, last time we contacted you we recommended that you kept your money in cash due to the unstable markets. If you have been watching the markets then you will have seen that they have been very erratic.

When advising on investing we always take in to account your attitude to risk, your objectives and current market conditions. Obviously it will be natural for you to wonder why your money was not in the markets instead of cash when they started to perform above expectation. The simple answer is the markets could have easily gone the other way and this has been proven correct as the FTSE stands at a 7 week low and around the level that it was when we decided to pull out.

We are constantly reviewing and studying the markets as well as researching the “experts” opinions from a vast range of sources that we subscribe to. Although we still feel that a cash investment is right for some of our clients we are always looking to re-enter the market if we feel it is the RIGHT time for YOU.

To recap: Global markets have been extremely volatile of late and there have been instances of large gains and large losses. For many the time is still not right for investment. We have produced a longer write up of our thoughts on global markets which is available to all clients on request. Please email Patrick Leonard at: pat@reevesifa.com for a detailed market report.

The article above is intended to provide general information and does not represent a personal recommendation of any product or service. The value of investments can fall as well as rise and you may not get back the full amount invested. Past performance is not a guide to future returns. The sections within this article are opinion only and do not constitute advice. Charges may be applicable to any investments you make and are subject to change without prior notice. Please refer to our brochure for information on our other products and services.

We are adding a new monthly installment to our Blog called Current Economic Thoughts. We will use it to show you the analysis of the markets and economy over the last month and finalise it with thoughts on the future. This is the August 2010 version.

As you know, last time we contacted you we recommended that you kept your money in cash due to the unstable markets. If you have been watching the markets then you will have seen that they have been very erratic.

When advising on investing we always take in to account your attitude to risk, your objectives and current market conditions. Obviously it will be natural for you to wonder why your money was not in the markets instead of cash when they started to perform above expectation. The simple answer is the markets could have easily gone the other way and this has been proven correct as the FTSE stands at a 7 week low and around the level that it was when we decided to pull out.

We are constantly reviewing and studying the markets as well as researching the “experts” opinions from a vast range of sources that we subscribe to. Although we still feel that a cash investment is right for some of our clients we are always looking to re-enter the market if we feel it is the RIGHT time for YOU.

To recap: Global markets have been extremely volatile of late and there have been instances of large gains and large losses. For many the time is still not right for investment. We have produced a longer write up of our thoughts on global markets which is available to all clients on request. Please email Patrick Leonard at: pat@reevesifa.com for a detailed market report.

The article above is intended to provide general information and does not represent a personal recommendation of any product or service. The value of investments can fall as well as rise and you may not get back the full amount invested. Past performance is not a guide to future returns. The sections within this article are opinion only and do not constitute advice. Charges may be applicable to any investments you make and are subject to change without prior notice. Please refer to our brochure for information on our other products and services.

Thursday, 26 August 2010

Salary Sacrifice FAQs

Apologies for the lack of Blogs in recent weeks. It has been a hectic month at Reeves Independent, with various staff members taking their holiday's to warm climates, with the exception of the boss who had a week in Torquay (each to their own).

Recently we have done a number of salary sacrifice cases. Therefore we have done a Blog on some of the FAQ's we have been getting & provided answer to these.

It can be used with any type of UK registered pension plan – i.e. individual or group personal pension/stakeholder or occupational money purchase/final salary schemes. The main point to remember is that there must be an employer willing and able to make payments to the scheme after the exchange is made.

Can the self-employed use a salary exchange arrangement?

As there’s no employer to make a pension payment on their behalf, the self-employed cannot set up a salary exchange arrangement.

How can salary exchange be set up with a pension plan?

The employee exchanges an amount of salary that they would have otherwise paid to their pension plan. The employer then pays the amount exchanged to the pension plan as an employer payment. For example:

- Employee earns £20,000 gross yearly

- Employee currently pays 5% of salary to a pension plan – that’s £1,000 yearly

- Employee exchanges £1,000 of gross salary

- Employer pays this £1,000 (plus any employer payments) to the pension plan.

Can pension payments be increased just by using salary exchange?

Yes. Depending on how the NIC and tax savings generated are used, there are several options available. Our calculator can deal with the following four options:

None of the tax and NIC savings generated are used:

- Employer saves as they pay less NICs on a reduced salary.

- If it’s the current employee pension payment that’s being exchanged their take home pay increases as they are paying less tax and NICs, albeit on a reduced gross salary.

- Pension payments remain the same.

Employee take home pay remains the same:

- Employer saves as they pay less NICs on a reduced salary.

- If it’s the current employee pension payment that’s being exchanged, they can exchange slightly more so that their take home pay remains the same.

- The pension payment increases by the extra amount the employee exchanges.

The employer reinvests their NIC savings into the pension plan:

- Employer reinvests their NIC saving into the pension plan.

- If it’s the current employee pension payment that’s being exchanged their take home pay increases as they are paying less tax and NICs, albeit on a reduced gross salary.

- The pension payment increases by the amount of the NICs savings that the employer makes.

Employee take home pay remains the same and the employer reinvests their NIC savings into the pension plan:

- Employer reinvests their NIC saving into the pension plan.

- If it’s the current employee pension payment that’s being exchanged, they can exchange slightly more so that their take home pay remains the same.

- The pension payment increases by the extra amount the employee exchanges plus the amount of the NICs savings that the employer makes.

Higher rate and additional rate taxpayers can claim additional tax relief. Does this affect the salary exchange calculation?

This depends on whether the exchange is being set up in a personal pension/stakeholder pension plan or an occupational pension scheme:

Personal pension/stakeholder pension (relief at source)

In the vast majority of these plans, pension payments are deducted from net pay – i.e. after tax has been deducted. These pension payments are then grossed up by the pension provider at basic rate only. The amount that can be claimed back depends on the individual’s tax position and their total taxable earnings.

Occupational pension scheme (net pay arrangement)

In these schemes, payments are normally deducted from gross pay i.e. - before tax - this has the effect of giving full tax relief on any pension payments paid. Our calculator will show this where the individual is a higher rate or additional rate tax payer by showing the payment before the exchange as being deducted from gross pay.

Will HMRC restrict or remove salary exchange arrangements in the future?

Whilst there’s no straight answer to this as it’ll depend on Government attitudes going forward, HMRC have published guidance together with questions and answers on salary exchange. So it seems likely that at least in the short term, salary exchange will continue to be available.

How can any employer NIC savings generated through salary exchange be used?

The NIC savings the employer makes can be used in many ways. For example they can be used to provide other employee benefits, increase pension payments, shore up deficits in a defined benefit schemes, or the employer may simply keep the savings. Remember however that the actual amount of salary that the employee exchanges MUST be used to provide a non-cash benefit to the employee, such as childcare vouchers, or pension plan payments.

Follow us on Twitter http://twitter.com/#!/reevesifa or on Facebook http://www.facebook.com/home.php

Monday, 23 August 2010

Improve Yourself Now = Brighter Future

“The time I spend improving myself now always pays bigger dividends later“.

Self-improvement is an investment of time and energy instead of an investment of money, but both pay excellent returns. It can improve your health, your emotions, your career, and your financial state. Here are four big areas anyone can work on in their spare time – and notes on exactly how to make it happen.

Improve your health - Just walking thirty minutes a day for twelve years adds, on average, 1.3 healthy years to your life. That’s 49 days of walking in exchange for 1.3 years of additional life – a brilliant trade. Doing more intensive exercise can add even more – 3.7 years of life on average.

Lets break this down, on average, a thirty minute walk will add almost five hours to your life. Go on a thirty minute walk each night after work and a single week’s worth, on average, will add a day to your life. That’s a profound argument for improving your health, even by taking simple steps.

Just because you are starting to get into exercise doesn’t mean that you have to neglect your usual hobbies. You can do sit-ups whilst watching Coronation Street and can listen to your favourite music on your ipod whilst you’re on the treadmill.

Improve your knowledge - “Knowledge is the base upon which creativity is built“. Exposure to new ideas and new angles in a mix with the unique set of ideas and life experiences you already have make it more and more likely that you’ll be able to produce unique ideas – and those unique ideas can be incredibly valuable.

One powerful way to do this is to read (you‘re obviously good at that as you‘re reading our blog :D). Take on a book that challenges you and pushes the way you think. This could be a sci-fi book, or it could be an autobiography that really inspires you and makes you want to achieve your goal.

Another effective way to get there is through conversation with a person willing to engage ideas. Share your thoughts, listen to what they share, and debate their relative merits. Accept that criticism of an idea that you presented is not criticism of you, but of the idea itself. This doesn’t have to be in person, the internet is huge, full of forums on every issue you could imagine. From Lindsay Lohan’s latest hair doo, to complex religious and scientific issues, if you want to discuss something then it’s very likely there will be someone out there that will put up a different point of view.

Improve your personal nature - Knowing who you are – your strengths, your weaknesses, your joys, your sorrows – makes it a lot easier to navigate the minefield of life. It’s well worth your time to figure out who you are and what you truly value.

Spend some time being introspective. Ask yourself how you honestly feel about the elements in your life. Are these things bringing you joy or sadness? Why? What elements, you ask? Look at everything: your health, your relationships, your activities, your possessions, and so on.

This type of introspection can be very difficult. Often, we want to feel certain ways about certain things and, on some level, we convince ourselves that we do. Digging through that, figuring out our true feelings, and acting on them results in nothing but life improvement.

Improve your relationships - Most relationships need some amount of care and feeding, but in the busy nature of modern life, it’s easy to overlook the care and feeding that some of our most important relationships require.

Take some time and simply talk to your spouse about how life is going. Give your mother a long phone call. Get in touch with your siblings. Look up some of your close friends that you’ve drifted away from over time. Listen to what they’re saying – appreciate their contribution to your life. Letting work take over your life only ends up in failure and depression. Remember you work hard for a happy and prosperous future, do you really want to spend that alone?

Contact Reeves Independent on 0871 271 270 to speak to one of our financial advisors who will be more than happy to have a chat with you about retirement planning or pensions.

Friday, 20 August 2010

Quote Of The Day 20/8/10

In any moment of decision, the best thing you can do is the right thing, the next best thing is the wrong thing, and the worst thing you can do is nothing. (Theodore Roosevelt)

Wednesday, 18 August 2010

Quote Of The Day 18/8/10

“Nothing can stop the man with the right mental attitude from achieving his goal; nothing on earth can help the man with the wrong mental attitude“. (Thomas Jefferson)

Tuesday, 10 August 2010

Fund Focus July 2010

Fund Focus - July 2010

Shorder Income Fund

Fund Aims:

The fund's investment objective is to provide a growing income, predominantly from investment in UK equities. In seeking a yield higher than that offered by the major UK equity indices, the fund will invest primarily in above-average yielding equities rather than fixed interest securities. Investment will be in directly held transferable securities. The fund may also invest in collective investment schemes, warrants and money market instruments.

Fund Size: £1,361.0m

Launch Date: 31 May 1987

Sector: UK Equity Income

About the sector - UK equity income

The UK Equity Income sector is limited to funds which invest at least 80 per cent of their assets in UK equities and which aim to achieve a historic yield on the distributable income in excess of 110 per cent of the yield on the FTSE All Share index. The equity income sector is one of the more popular sectors among investors, and is often the core income producing component, favoured ahead of fixed income alternatives.

The funds in the sector have a number of strategies they can follow to generate income, the most obvious being to invest in high yielding stocks. The number of quality companies with stable and growing earnings whose shares are attractively valued, are few and far between however, and there is a danger of concentration in a relatively low number of stocks. The strategy can be supplemented by looking for unfashionable companies that never the less remain sound and are trading at a yield above intrinsic value. This is one of the most common approaches by funds in the sector and is primarily a value strategy and is contrarian by nature, a fall in stock prices can be a good thing as it allows funds to capture attractive yields, thus while total return may fall, income remains solid.

Alternatively, funds have the option to invest in growth stocks that have large potential for capital appreciation, and synthetically manufacture dividends by selling shares and return the proceeds to investors in the form of income. This strategy allows for broader diversification away from the few high income stocks available, although it is very susceptible to market movements. In the event of a down turn, the fund would be forced to sell shares at unfavourable prices in order to generate income, which would severely impact on the value of the fund. Many funds now employ a combination of these two approaches in order to maximise their returns and the income available.

Source of information: Financial Express

About the manager - Schroders

Schroders runs a diversified asset management business managing about £167.9bn of assets across multiple geographies, asset classes and distribution channels, ranging from banking through intermediary channels to institutions in both pensions and insurance, and to official institutions.

Schroders is primarily an equity manager, although it does offer fixed income and property. It also has a multi-asset business, and offers quant driven equity funds, and a range of alternatives including hedge fund of funds, its own structured products group, commodities and emerging market debt.

Source of information: Financial Express

Comments

The Schroder Income fund exceeded expectations in July and has been the leading fund in our portfolio in terms of return. According to Morningstar data the fund has returned 8.84%* over the period 30/06/2010 to 30/07/2010. This is extremely encouraging given the global economic climate and the difficulties facing many fund managers.

Having said this, the fund was still in the negative over the 3 month period (30/04/2010 to 30/07/2010), returning minus 1.86%*, again, according to Morningstar data. It is still quite apparent that global markets are as uncertain and volatile as ever and we do not expect this to change in the short term, especially considering the fragility of the economic recovery across Europe and the US where growth has been affected by economic headwinds. Many of our client’s are still exercising caution with their portfolio’s and a number are still holding a significant proportion of cash. For those that wish to avoid any short term fluctuations in value, holding cash is the best method for achieving this. For those that wish to discuss their strategy for re-entering the market please call one of our advisers on 0871 271 1280.

*Source data morning star

*Source data morning star

Reeves Independent, 47 St. Georges Terrace, Jesmond, Newcastle upon-Tyne, NE2 2SX,

0871 271 1280

Authorised and Regulated by the Financial Services Authority

This document is intended to provide general information and does not represent a personal recommendation of any service or product. The value of investments can fall as well as rise and you may not get back the full amount invested. Past performance is not a guide to future returns. The sections within this document are opinion onlyand do not constitute advice. Other charges may be applicable and are subject to change without prior notice. Please refer to our brochure for information on our other products and services. We will always recommend that our clients seek advice before making a decision on whether to invest.

Monday, 9 August 2010

Common Investment Mistakes

There is a difference between investor and investment performance. In 2008 the US stock market, as measured by the S&P 500, lost 37.7%. But investors did even worse by losing 41.6%. The US bond market, as measured by the Lehman Aggregate Bond Index gained 5.2%, but bond investors actually lost 11.7%. In other words, the stock market as an investment outperformed investors by 3.9% and the bond market beat investors by 16.09%.

This is not just a one year phenomenon. Every year the Dalbar company measures how investors performed compared to the capital markets themselves. For the 20-year period from 1988-2007, the US stock market, as measured by the S&P 500 returned 11.81%, but equity investors only earned 4.48%. For the same period, the US bond market, as measured by the Lehman Aggregate Bond Index, gained 7.56%, but fixed income investors earned only 1.55%. In other words, over the past 20 years the stock market outperformed investors by 7.33% and the bond market beat investors by 6.01%. If we’re not shocked, we should be.

At Reeves Independent we don’t like to rest on our laurels. We have studied WHY certain investors have failed previously and have looked at each aspect to make sure that we don’t make any mistakes.

So, what are investors doing wrong? How do they unintentionally sabotage themselves? These are ten broad categories of mistakes that we have seen investors make:

1. They have no strategy

2. Their strategy is to beat the market

3. They don’t hold themselves accountable

4. They listen to the media more than the math

5. They don’t count the impact of costs

6. They let emotions overrule numbers

7. They don’t understand or set a portfolio time horizon

8. They don’t define long term

9. They don’t understand all the risks

10. They measure risk tolerance instead of risk capacity

Follow us on www.twitter.com/reevesIFA and keep checking the Blog where we will be talking about how we have counteracted all of the above to make sure that we offer the best advice possible when you invest.

This is not just a one year phenomenon. Every year the Dalbar company measures how investors performed compared to the capital markets themselves. For the 20-year period from 1988-2007, the US stock market, as measured by the S&P 500 returned 11.81%, but equity investors only earned 4.48%. For the same period, the US bond market, as measured by the Lehman Aggregate Bond Index, gained 7.56%, but fixed income investors earned only 1.55%. In other words, over the past 20 years the stock market outperformed investors by 7.33% and the bond market beat investors by 6.01%. If we’re not shocked, we should be.

At Reeves Independent we don’t like to rest on our laurels. We have studied WHY certain investors have failed previously and have looked at each aspect to make sure that we don’t make any mistakes.

So, what are investors doing wrong? How do they unintentionally sabotage themselves? These are ten broad categories of mistakes that we have seen investors make:

1. They have no strategy

2. Their strategy is to beat the market

3. They don’t hold themselves accountable

4. They listen to the media more than the math

5. They don’t count the impact of costs

6. They let emotions overrule numbers

7. They don’t understand or set a portfolio time horizon

8. They don’t define long term

9. They don’t understand all the risks

10. They measure risk tolerance instead of risk capacity

Follow us on www.twitter.com/reevesIFA and keep checking the Blog where we will be talking about how we have counteracted all of the above to make sure that we offer the best advice possible when you invest.

Friday, 6 August 2010

Personal Well Being

This is an introduction to a series we are going to do on personal well being, concentrating on happiness and relationships. We at Reeves Independent believe that a happy and healthy lifestyle added with hard work equals to a prosperous future.

In this series we will be talking about the following;

- Improving your health

- Improving your knowledge

- Improving your personal nature

- Step by step way of improving and expanding friendships / relationships.

We will be concluding the series with an article on ambition, something that we are very passionate about. Ambition is the desire for personal achievement. It provides the motivation and determination necessary to help give direction to life. Ambitious people seek to be the best at what they choose to do for attainment, power, or superiority.

Nothing can stop the man with the right mental attitude from achieving his goal; nothing on earth can help the man with the wrong mental attitude. (Thomas Jefferson)

Thursday, 5 August 2010

An Introduction To Salary Sacrifice

Some facts for you to think about before reading this article..

Facts-

-13.4m people DO NOT save sufficiently for their retirement

-Only 6% of people accept a lower standard of living in their retirement (This means 94% of people -want to continue or improve their standards of living once they have retired. The earlier you start saving the more money you are going to have when you retire thus letting you live a more comfortable life post work

- Men and women can expect to live to 82 and 85 years respectively

In the first of this 5 part series we will be talking about the benefits of Salary Sacrifice. Salary sacrifice is an agreement between the employee and the employer. The employee’s contract of employment is altered to reflect that they have agreed to exchange part of their future gross salary or bonus entitlement in return for a non-cash benefit such as an employer pension payment.

Still don’t understand? Here are some facts about Salary Sacrifice.

-Employees save on their income tax and NIC bill.

-Employers save on their NICs bill.

-Reinvesting these savings can help boost pension savings.

-Employees are no worse off in terms of net pay.

-Employers are no worse off as the cost of providing salary stays the same.

-Gains good working relationships between employers and employees.

Interested? Want to ensure you have a comfortable lifestyle once you retire without having to worry where the money is going to come from to pay the next heating bill? Join us on www.twitter.com/reevesifa and be the first to hear about our new articles on how to save yourself money. Next week we will be talking about option A which will be telling you how to increase your pension fund without paying a penny!

First Post

We've been down the Blogging route before, but this time we promise to update it more regularly. Things are starting to expand for Reeves Independent. We have expanded our staff team allowing us to spend more time on finding the best investments for you. We have also decided to spend alot more time talking to our clients, so expect a call pretty soon!

For those of you that don't know who we are, we are Reeves Independent. We are based in Jesmond, Newcastle and we have been in financial services for the last 15 years. We offer a service called "the portfolio management service" to help old and new clients' alike, achieve their investment goals.

Coming up for you in the next few weeks/months, we will be putting up articles/blog posts detailed with information about how to save/make money. We also now have a twitter page and you can find us (follow us :D) on www.twitter.com/reevesifa

If you have a blog, link us and we'll return the favour, keep checking the blog page as we will be giving out some amazing freebies!

Reeves

For those of you that don't know who we are, we are Reeves Independent. We are based in Jesmond, Newcastle and we have been in financial services for the last 15 years. We offer a service called "the portfolio management service" to help old and new clients' alike, achieve their investment goals.

Coming up for you in the next few weeks/months, we will be putting up articles/blog posts detailed with information about how to save/make money. We also now have a twitter page and you can find us (follow us :D) on www.twitter.com/reevesifa

If you have a blog, link us and we'll return the favour, keep checking the blog page as we will be giving out some amazing freebies!

Reeves

Subscribe to:

Comments (Atom)